- Home

- Administration

- Business Office

- 2025 Budget Information

Administration

Page Navigation

-

Administration

-

Business Office

- 2024 NYS Comptroller Audit

- 2016 NYS Comptroller Audit

- 2017 Budget Information

- 2018 Budget Information

- 2019 Budget Information

- 2020 Budget Information

- 2021 Budget Information

- 2022 Budget Information

- 2023 Budget Information

- 2024 Budget Information

-

2025 Budget Information

- 2025 Budget Newsletter

-

2025 Budget Newsletter (Translate)

- 2025 Budget Newsletter P1 (Cover Page)

- 2025 Budget Newsletter P2 (Letter from the Board)

- 2025 Budget Newsletter P3 (The R-H Budget Supports...)

- 2025 Budget Newsletter P4-5 (Strategic Plan/Goals)

- 2025 Budget Newsletter P6 (Tax Comparison and Budget Notice)

- 2025 Budget Newsletter P7 (Revenues/Expenditures)

- 2025 Budget Newsletter P8-9 (Component Budget)

- 2025 Budget Newsletter P10 (Letter/Propositions)

- 2025 Budget Newsletter P11 (BOE Candidates)

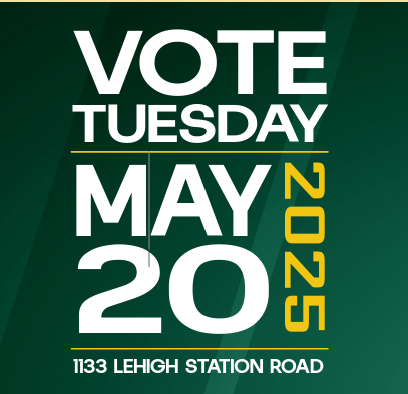

- 2025 Budget Newsletter P12 (Voting Information)

- Budget Talk

- Federal Stimulus Funds 2021-2022

- Federal Stimulus Funds & Foundation Aid Increase 22-23

- Federal Stimulus Funds and Foundation Aid Increase 23-24

- Financials

- Freedom of Information

- Grants

- Reserve Funds

- Smart Bond

- Transparency Reporting

- Community Relations

- Human Resources and School Accountability

- Instruction

- School Operations

- Student & Family Services

- Superintendent of Schools

-

Business Office

- Organizational Chart

- Vision 2037

- Inclusivity at R-H

- Summer Meals 2025

-

2025-2026 DISTRICT BUDGET PROPOSAL

Highlights:- Preserves and strengthens instructional programs for more than 5,500 students

- Continues capital reserve planning to support the district’s aging infrastructure

- Ensures ongoing mental wellness initiatives to support Rush-Henrietta students

- Aligns spending with district priorities and Vision 2037 strategic plan

Did You Know?

- One of Rush-Henrietta’s objectives is to maintain existing programs and services while minimizing impact to the taxpayers.

- If the proposed budget is approved, Rush-Henrietta again will have one of the lowest tax rates among the local 17 suburban school districts.

- Rush-Henrietta has had one of the lowest true value tax rates in Monroe County for many years.

- Taking into account the School Tax Relief (STAR) benefit - for which all homeowners are eligible - a district resident owning a house assessed at $300,000 would see school tax rise by $106 annually.

The Basics

Proposed Budget: $179,134,741

This is the amount of money deemed necessary to provide programs and services to students.

Budget-to-Budget Change: 5.2%

This is the amount of money deemed necessary above and beyond last year’s budget.

Estimated Tax Rate Change: -5.98%

This preliminary tax rate decrease is based on the town of Henrietta reassessment. The final tax rate may be even lower. Since the tax levy must stay under the tax cap, the increase in assessments drives a lower tax rate.

Tax Levy Change: 4.2%

The school tax levy is the total dollar amount the district will collect from property owners to support the annual operating budget. Once approved, this amount is fixed and does not increase if assessments increase.